The Definitive Guide to Corporate Tax Payment Agreements

Wiki Article

The Single Strategy To Use For Corporate Tax Consultation

Table of ContentsLittle Known Facts About Irs Collections Representation.The smart Trick of State Of Michigan Collection Division Representation That Nobody is Talking AboutUnknown Facts About State Of Michigan Tax NotificationsState Of Michigan Collection Division Representation Fundamentals ExplainedSome Ideas on Irs Tax Notifications You Should KnowRumored Buzz on Statute Of Limitations Analysis

Typically connected to Ben Franklin is this famous quote:"Nothing is certain with the exception of death as well as tax obligations." Many individuals discover tax issues to be complex and also burdensome, as well as, instead of doing their own tax obligations, they typically favor to hire a professional (Corporate Tax Services). Taxpayers who have significant assets or intricate individual funds, might opt to collaborate with a tax obligation expert, who can leverage her extensive expertise and experience to reduce her clients' tax obligation liabilities and shield their rate of interests.Tax legislations change frequently, as well as several individuals and also entrepreneur are just not aware of the myriad of policies that govern reductions, credit ratings and also reportable income. Because of this, the average taxpayer might make blunders that can cause the underpayment or over payment of taxes. If the taxpayer underpays his tax obligations, he may go through an IRS audit, with feasible penalties.

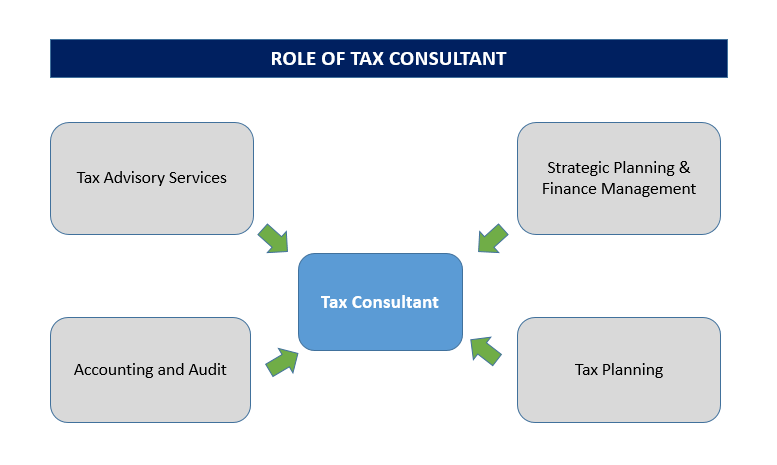

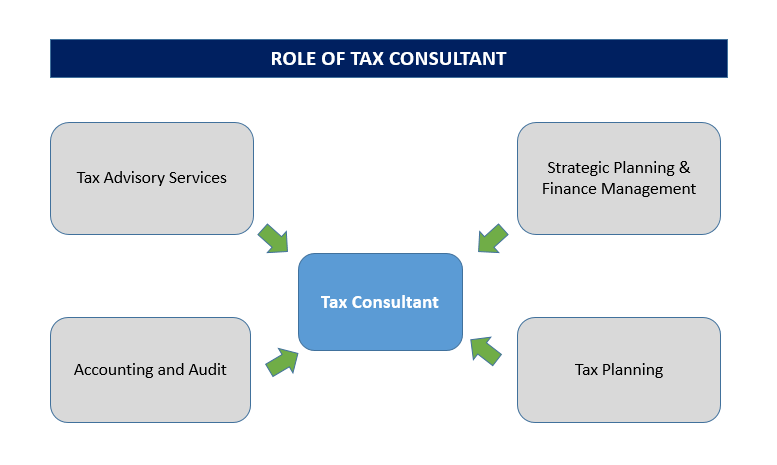

A tax consultancy is an organization that gives skilled advice to tax obligation filers. An excellent tax consultant comprehends tax regulations, as well as has the ability to recommend techniques that minimize commitments while also decreasing the possibility of an audit that can lead to a dispute with the IRS or with a state tax agency.

Some Of Innocent Spouse Defense

A tax preparer is a person who prepares earnings tax obligation forms, such as the 1040 or 1040 EZ, for others. The trade is freely regulated: tax preparers normally finish a short training program, register with the IRS to receive a tax preparer number, and, in some states, must register with the state firm before beginning job. hop over to these guys.

Aiding customers with tax obligation concerns during and after a substantial life transition, such as a marriage, separation, death of a partner or birth of a youngster. Completing complicated tax return as well as timetables that a lot of tax preparers are unfamiliar with. Standing for a customer in negotiations with the internal revenue service or other taxation firms.

Below are some regular needs for ending up being a tax expert: Becoming a tax preparer typically just calls for completing a brief training course. Some states, such as California, require tax obligation preparers to finish a course accepted by the regulatory firm that signs up or certifies preparers. Individuals who want a career as a tax obligation specialist should ask their state's regulative body to give them with a list of accepted training course providers (you can try this out).

The 45-Second Trick For Audit Protection Annual Plans

Training courses funded by private firms may be totally free of fee or require just the purchase of some books. Oftentimes, people that do well in look here these programs may be provided employment by the tax prep company. An additional choice for those who have an interest in tax prep work as an occupation is to become an IRS Tax obligation Volunteer.